Wills & Estates – What’s Your Legacy Plan?

September 15, 2020

5 Ways That Lead to $avings

October 7, 2020

If you still have questions about the Canadian Emergency Wage Subsidy (CEWS) – you’re not alone. We’ve scratched our heads a few times too!

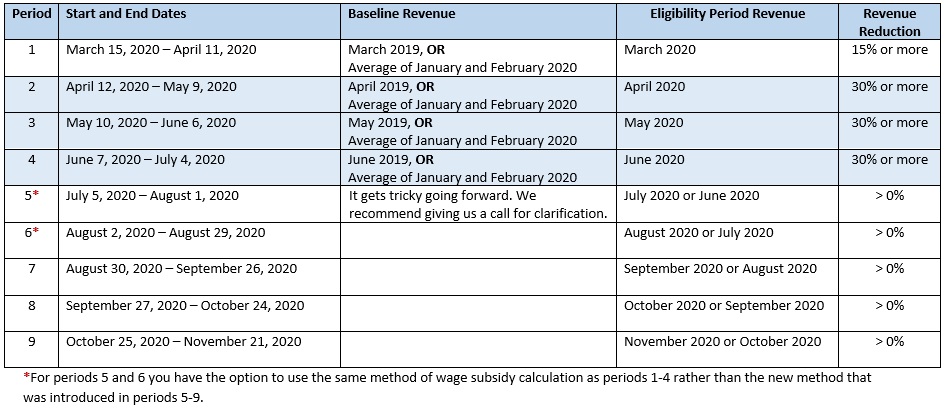

For the first sixteen weeks (Periods 1-4), eligible employers that saw a drop of at least 15% of their qualifying revenue qualifying revenue in March 2020 and 30% for the following months of April, May and June, when compared to their qualifying revenue for the same period in 2019 (or the average of January and February 2020), qualified for the wage subsidy.

However, things changed dramatically starting in Period 5. For the following twenty weeks (Periods 5-9) the wage subsidy has been modified to include ALL eligible employers that experience ANY decline in revenue for a claim period.

Just to recap, CEWS applies to you if your business:

1) Experienced a decline in revenue when comparing the current or previous month to either:

- the same month in 2019 (based on revenue recognized or cash received);

OR

- an average of January and February 2020 (based on revenue recognized or cash received).

2) Has at least one employee (arm’s-length or non-arm’s-length).

3) Had a CRA payroll account on March 15, 2020.

Please don’t hesitate to give us a call if you have any questions or would like assistance with your CEWS application. Our experienced SYC team is here to help!