Corona Virus – Because We Care, We’ll Prepare

March 10, 2020

A Unique, Yet Memorable CO-OP Work Term at SYC

April 7, 2020

Our understanding of the most important provision of the current relief programs is summarized below. This information is currently as of April 1, 2020 only.

Canadian Emergency Wage Subsidy (CEWS)

On April 1st, 2020 the government provided details on the 12-week wage subsidy. The subsidy is 75% of annual employee salary, up to an annual salary of $58,700 (i.e., up to $847 per week, per eligible employee). Here are some new details:

- The CEWS subsidy will be available for both large and small employers that have lost at least 30% of revenue due to COVID-19, regardless of the number of employees.

- The 30% reduction will be determined by comparing the employer’s gross revenue in March, April and May, 2020 to the same month in 2019. Each month that employers experience a 30% reduction in revenue must be applied for separately.

Eligibility would generally be determined by the change in an eligible employer’s monthly revenues, year-over-year, for the calendar month in which the period began. In determining monthly revenues, the wage subsidy would NOT be considered in revenues.

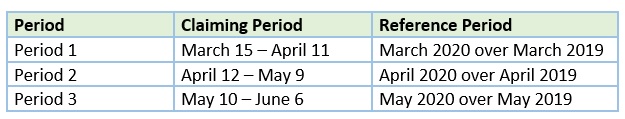

The Eligible Periods are as follows:

Each month will be a separate application. It may be possible that a company is not eligible for Period 1, but is eligible for Periods 2 and/or 3.

- These changes will be retroactive starting from March 15, 2020 to June 6, 2020, and there is no overall limit on the amount of subsidy than an eligible employer may claim.

- For qualifying employers to receive funds directly from CRA, they must provide CRA the pre-crisis income and the earnings actually paid per employee.

- Application can be made through the My Business Account CRA portal, and the new links are expected to be available next week. All employers should be certain they have a My Business Account established with the CRA – your accountant CANNOT apply for this relief for you!

- In the meantime, businesses should ensure they are set up for direct deposit with CRA to expedite the payment process.

- The subsidy is fully taxable.

10% Temporary Wage Subsidy

Businesses who do not qualify for the CEWS, may still qualify for the previously announced temporary three-month taxable subsidy. This subsidy is available on up to 10% of eligible employee salaries from March 18 to June 20, 2020, with a cap of $1,375 per employee and a cap of $25,000 per employer. The subsidy is fully taxable.

For employers that are eligible for both the CEWS and the 10% Temporary Wage Subsidy for a period, any benefit from the 10% wage subsidy for remuneration paid in a specific period would generally reduce the amount available to be claimed under the CEWS in that same period. In other words, eligible employers can choose to reduce remittances up to 10% of the employee’s salary and then receive the CEWS. However, they cannot be added on top of each other. The benefit is limited to 75%, not 85%.

Credit Available to Small and Medium Size Business (SMEs)

Canada Emergency Business Account

This new account will provide interest-free loans of up to $40,000 to small businesses and not-for-profits, to help cover their operating costs during a period where their revenues have been temporarily reduced. To qualify, these organizations will need to demonstrate they paid between $50,000 to $1 million in total payroll in 2019.

Loan Guarantee

Export Development Canada (EDC) is working with financial institutions to issue new operating credit and cash flow term loans of up to $6.25 million to SMEs.

Co-Lending Program

Business Development Bank of Canada (BDC) is working with financial institutions to co-lend term loans to SMEs for their operational cash flow requirements.

Eligible businesses may obtain incremental credit amounts of up to $6.25 million through the program. These programs will roll out in the three weeks after March 27.

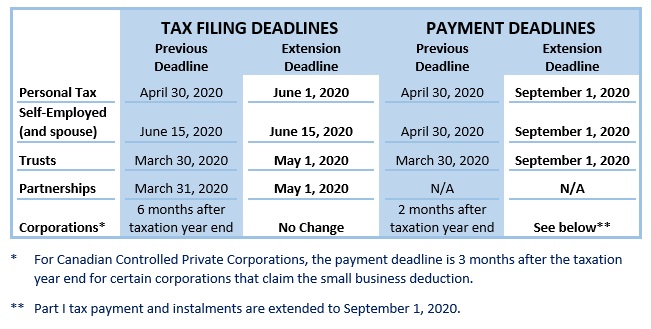

Tax Filing and Payment Flexibility

Income Tax Extension

The government is providing the following extensions for tax deadlines.

Employer Health Tax Support for Ontarians

The Ontario government increased the Employer Health Tax exemption for 2020 from $490,000 to $1 million and have introduced a five‑month relief period for Ontario businesses who are unable to file or remit their provincial taxes on time due to the special circumstances caused by the coronavirus (COVID‑19) in Ontario. This is effective March 20, 2020.

Deferral of Sales Tax Remittance and Customs Duty Payments

The government will allow businesses, including self-employed individuals, to defer until June 30, 2020 payments of the Goods and Services Tax / Harmonized Sales Tax (GST/HST), as well as customs duties owing on their imports.

- HST Monthly Filers – the deferral will apply to GST/HST remittances for the February, March and April 2020 reporting periods.

- HST Quarterly Filers – the January 1, 2020 through March 31, 2020 reporting period.

- HST Annual Filers – the amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

- GST and Customs Duty Payments – deferral will include amounts owing for March, April and May. These amounts were normally due to be submitted to the Canada Revenue Agency and the Canada Border Services Agency as early as the end of this month.

All HST returns must continue to be filed on time.

If you have any questions regarding any of the above information, please feel free to contact us.