Why Your Retirement Plan Needs a “Checkup”

August 28, 2018

Bookkeeping – Working Smart

November 14, 2018

In November 2016, we blogged about Tax Free Savings Accounts. Since inception, CRA has been auditing TFSA accounts and this has resulted in penalties to taxpayers who have unknowingly over-contributed. How can you be sure you have room for your TFSA contributions? Here are some tips.

Understand TFSA Withdrawals

Let’s say you’ve withdrawn funds from your TFSA. This has left room to re-contribute later, right? Not necessarily. If you withdraw funds from your TFSA, you must remember that this does not create corresponding contribution room until the next calendar year. If you contribute sooner – you could be penalized.

Ensure TFSA Transfers Are Done Correctly

If you wish to transfer funds from one TFSA to another, the transaction should be processed as a “direct transfer” by your financial institution. Otherwise, it could be viewed as a “funds withdrawn” and “funds contributed” scenario. When the latter happens, contribution room for the withdrawal will not be reinstated until the next calendar year. So, when funds are not transferred correctly, and you contribute too soon – penalties may also apply.

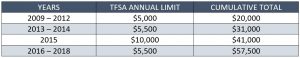

Keep Up-to-date with Changing TFSA Room Limits

You can have more than one TFSA at any given time, but the total amount you contribute to all your TFSAs cannot be more than your available TFSA contribution room for that year or you could get dinged with a penalty. It’s good to check each year to see if the annual limit has changed:

Always Be Aware of Your TFSA Balance

CRA has made it easy to ensure that we don’t over-contribute. Before you contribute, log into CRA’s My Account for Individuals > Click RRSP and TFSA tab > Contribution Room > Next.

This takes you to your TFSA page where you can find out your contribution room as of the current taxation year.

Following these simple tips can help you save money without worrying about unexpected penalties. Happy saving!