The 75% Canadian Emergency Wage Subsidy (CEWS) – EXTENDED to August 29, 2020

June 16, 2020

Canadian Emergency Wage Subsidy (CEWS) – Further Extension Announced

July 22, 2020

COVID-19 has resulted in many learning curves for 2020. For example, some of us are working from home for the first time. So, it’s not surprising that we’ve been asked by many clients if and how they can claim home office expenses.

As you would imagine, it’s tricky. Here’s what you need to know.

Definition of home office space

First, you must meet the qualifications of a home office space according to the Government of Canada, which is that it must be:

- Used principally (“principally” meaning “more than 50% of the time”) for the performance of office or employment duties. It can be any place in the home such as a kitchen or dining room, OR

- Used exclusively during the period to which the expenses relate, to earn employment income, and on a regular and continuous basis, used for meeting clients* or other persons in the ordinary course of performing the employment duties.

*It is the CRA’s view that “ ‘meeting customers or other persons’ as used in subsection 8(13) of the Income Tax Act includes only face to face encounters”. That said, we believe that video calls and phone calls constitute a “meeting” with clients in the context of the work-at-home COVID-19 scenario.

Employer responsibility

Once you have determined that you qualify, your employer must provide a signed T2200 Condition of Employment form which outlines the type of expenses that can be claimed as part of the employment contract.

What you can claim

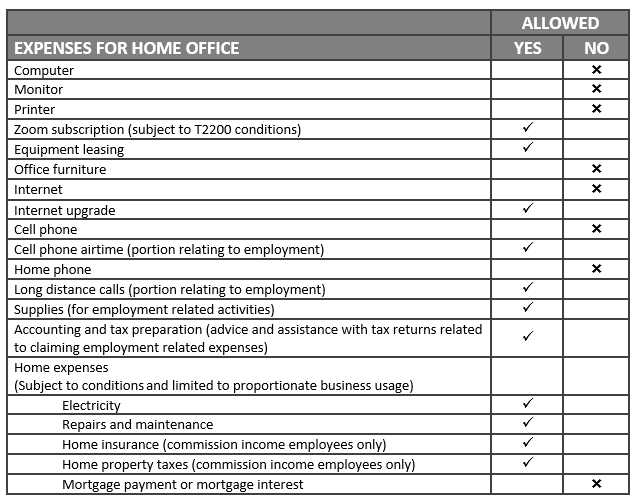

It starts to get tricky at this point. Here are some of the more common expenses incurred while working from home – but as you see – not all are claimable expenses. (Due to the pandemic, we will not cover expenses related to meals, entertainment, and travel costs).

How much of the “Home expenses” you can claim

Now you will need to calculate the proportionate business usage. There is no specific rule, it can be based on either:

- Square footage of the workspace as a percentage of the overall square footage of the home; OR

- Calculated based on business hours used as a percentage of total hours for mixed used home office. For example, if the business hours are 9:00 am to 5:30 pm for five days a week for 36 weeks, the business usage for year 2020 would be 15.45% (37.50/ 168 hours per week x 36/52 weeks).

Whatever approach you choose, it must be reasonable. You must also be able to provide CRA your supporting documentation (such as the workspace home floor plan and bills) if they should ask. In addition, the home office expense deduction is limited to the amount of employment income. Any unused deductions (although unlikely) can be carried forward and deducted against future employment income.

Special COVID-19 reimbursement for 2020

To assist the transition to home office, CRA allows a special rule for an employee to receive up to $500 for a reimbursement from the employer for the purchase of a computer used primarily for the benefit of the employer. This reimbursement is not taxable to the employee.

We hope this blog has helped flattened the learning curve as you get yourself organized to work from home. If you need any more information, don’t hesitate to give us a call.

Disclaimer: Information is based on existing tax law as at July 2020, subject to CRA changes/updates on claiming any home office expenses.