A Unique, Yet Memorable CO-OP Work Term at SYC

April 7, 2020

COVID-19 Updates to Important Subsidy Programs

April 21, 2020

Canadian Emergency Wage Subsidy (CEWS)

On April 1, 2020 the government provided details on the 12-week wage subsidy. The subsidy is 75% of annual employee salary, up to an annual salary of $58,700 for a maximum weekly subsidy of $847. Here are some new important details.

Eligibility update

As of April 8, 2020, the CEWS subsidy will be available to eligible employers who have a gross revenue reduction of at least 15% in March 2020 and a 30% reduction in April or May 2020.

How to calculate decrease in revenue

To measure the revenue loss/reduction, the employer has two broad options:

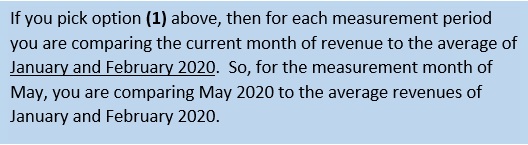

- Compare the current month in 2020 to the same month in 2019; or

- Compare the current month in 2020 to an average of their revenue for January and February 2020.

Once you pick the method as noted above, you must stay with this method for entire period of the subsidy.

Accounting method options

Employers would be allowed to calculate their revenues under the accrual method or the cash method, but not a combination of both. Employers would select an accounting method when first applying for the CEWS and would be required to use that method for the entire duration of the program.

How much is the subsidy and who else does it apply to?

Employers will also be eligible for a subsidy of up to 75% of salaries and wages paid to new employees.

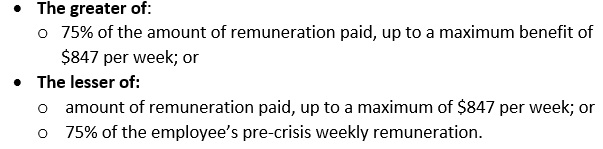

The subsidy amount for a given employee on eligible remuneration paid for the period between March 15 and June 6, 2020 would be:

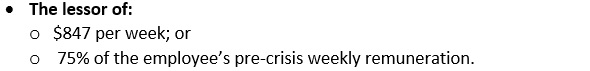

Special rules apply to wages paid to non-arm’s length employees (like employers and their family members), provided they were employed prior to March 15, 2020. The subsidy will be limited to the eligible remuneration paid in any pay period between March 15 and June 6, 2020, up to a maximum benefit of:

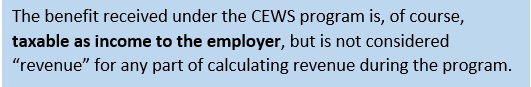

There continues to be no overall limit on the subsidy amount that an eligible employer may claim.

You Must Apply for A My Business Account NOW!

Without this special access account, you will NOT be able to apply for this subsidy.

If you are not sure whether you have a “My Business Account”, then you probably DON’T have one. It will take an investment of time and patience but it is mandatory for the application process. Here are some helpful reminders to get you started:

- First, figure out whose SIN will be associated with your corporate tax accounts with the CRA – likely the person who is currently a Director and major shareholders in the business. Then gather personal information on that person – you will need the 2018 personal tax return for that person in front of you as you move through this process.

- Watch this video – https://www.canada.ca/en/revenue-agency/news/cra-multimedia-library/businesses-video-gallery/register-mybusiness-account.html

- Go to this website https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/business-account.html

- At the bottom of that page start with “Register CRA” – in purple print .to begin the process.

- You cannot complete the process without receiving your security code. Regardless of what the video says about mail or e-mail options of getting this code, it ONLY comes by snail mail at this time. You will need to wait about 5-10 mailing days to obtain the security code and then you must return to the website to complete the registration process.